do u pay taxes when u sell a car

In effect youre. Thus you have to pay capital gains tax.

Understanding Taxes When Buying And Selling A Car Cargurus

Traditionally the buyer of a car is the one concerned about paying taxes.

. Unless its part of negotiations the. In addition to the above sales tax can also be charged on a county or municipal level. Answered by Edmund King AA President.

Thus you have to pay capital gains tax on. How do I avoid paying sales tax on a car in Idaho. When you trade in a vehicle instead of paying tax on the full value of the new car you are taxed based on the difference in value between the trade-in and the new vehicle.

However you do not pay that tax to the car dealer or individual selling the car. Still in some states this number can be lower around 3 or higher about 8. Used cars are not taxed in Alaska Delaware Montana.

In most cases you do not have to pay any taxes when you sell your car to a private seller or a company like The Car Depot. This is wildly over simplified tax advice. The answer to this question is no you do.

The seller of a classic vehicle may have to pay extra tax on his capital gain. At the same time some states dont have sales taxes at all. Most car sales involve a vehicle that you bought new and are.

However you must fill out Idaho Sales Tax Exemption Certificate Form ST-133 Section II and give the completed form to the clerk when you title and register the carThe organization car dealership radio station corporation etc. That list includes Alaska Delaware Montana New. You dont have to pay any taxes when you sell a private car.

The sales tax you originally paid when purchasing the car. Still you can use an average number to get an approximate amount you will have to pay in taxes. Typically most states charge between 5 and 9 for their sales tax says Ronald Montoya senior consumer advice editor at Edmunds.

If you sell it for less than the original purchase. As this article indicated if youre not making any profit out of your used vehicle by. The car sales tax is based on the state where you will register your vehicle so you will have to pay only the sales tax of the state you live in.

So if your used vehicle costs 20000 and you live in a. The sales tax on a new car might be 5 but the county might charge an additional 4. Of course there may be a tax benefit to trading your car instead of selling it but it depends on the state and it would only reduce sales tax on the new car you are buying.

Selling a car for more than you have invested in it is considered a capital gain. However you do not pay that tax to the car dealer or individual selling the car. Selling a car for more than you have invested in it is considered a capital gain.

When you sell a car for more than it is worth you do have to pay taxes. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. First off the home must be your primary residence at the time of sale and for at least 2 of the last 5 years it cannot have been the subject of a 1031.

The national average is around 57 of the car price. Income Tax Liability When Selling Your Used Car. Capital gains are either over the long or short term over the short period is taxed at up.

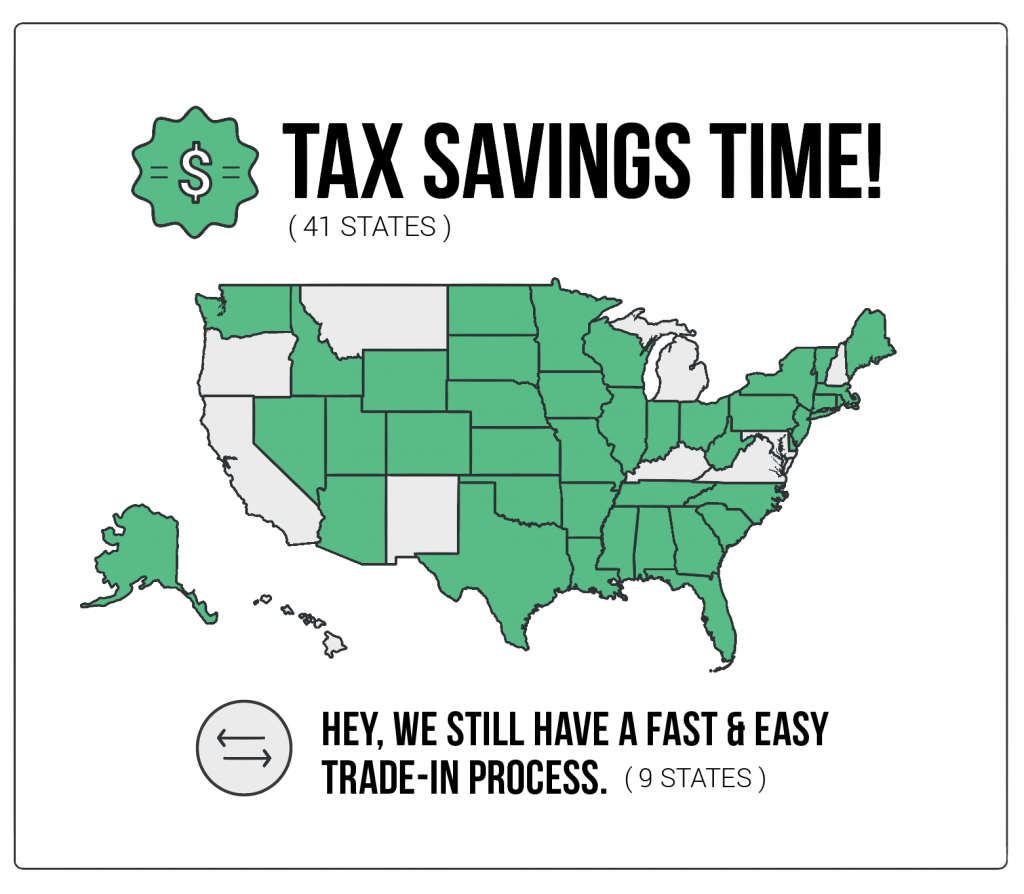

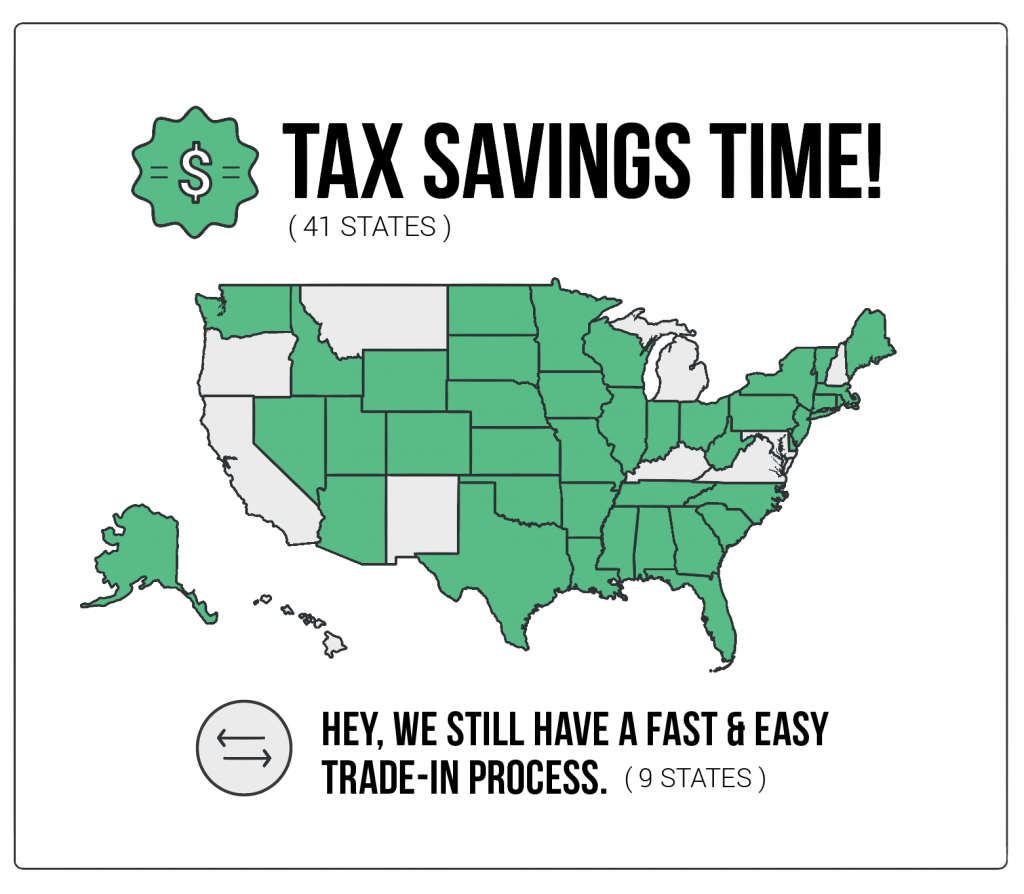

Even in the unlikely event that you sell your private car for more than you paid for it special. Not all states offer a trade-in sales tax break however and the tax break wont apply in states that dont charge taxes on car sales. If your trade-in is.

If your trade-in is. Trading a V6 for a V8 engine the adjusted basis of the car will. In a nutshell the Internal Revenue Service IRS views all personal vehicles as capital assets.

One of the top questions that many people have when they sell their used car truck or van is if they have to pay taxes on the money from that sale. You can make another deduction on top of that. When you sell a car for more than it is worth you do have to pay taxes.

When it comes to tax filing things might be a little complicated especially if youre selling a used vehicle. When you trade in a vehicle instead of paying tax on the full value of the new car you are taxed based on the difference in value between the trade-in and the new vehicle. If a car had been owned by the donor as non-business property and not depreciated and there are no major upgrades to the car eg.

Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. A capital gains tax is due on the sale if the sale price for the car is more than the adjusted basis of the car for the person who made the gift of the car. You dont have to pay sales tax because you didnt buy the car.

Understanding Taxes When Buying And Selling A Car Cargurus

Is It Considered Income If I Sell My Car The News Wheel

How To Sell A Car With An Existing Loan Forbes Advisor

When I Sell My Car Do I Have To Pay Taxes Carvio

How To Not Pay Sales Tax On Your Car Now You Know Youtube

Buying A New Car Use A Trade In To Get A Sweet Tax Credit In These 41 States By Vroom Vroom

Sell My Car In Cincinnati Oh Used Car Buyer And Auto Trade Ins Kings Toyota

Free Motor Vehicle Dmv Bill Of Sale Form Word Pdf Eforms

How To Gift A Car A Step By Step Guide To Making This Big Purchase

New York Dmv Chapter 3 Owning A Vehicle

Do You Pay Sales Tax On A Lease Buyout Bankrate

If I Buy A Car In Another State Where Do I Pay Sales Tax

Vehicle Sales Tax Deduction H R Block

How To Sell Your Car When You Still Have A Loan Nerdwallet

Capital Gains Tax What Is It When Do You Pay It

I Want To Sell My Car But I Still Owe Money News Cars Com

Does The Seller Have To Pay Tax On A Vehicle When He Sells It